Projects in South Jersey got a disproportionate chunk of the money awarded under tax incentive programs that are now under scrutiny by lawmakers and the state comptroller.

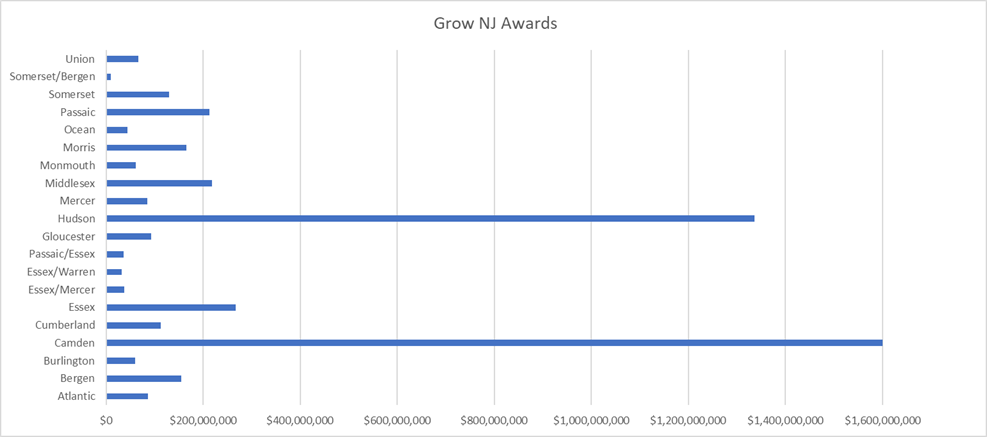

The eight South Jersey counties, which account for a little more than a quarter of the state’s population, received almost $2 billion and some of the single biggest incentives from $4.8 billion awarded over the last five years, according to a Route 40 analysis of two New Jersey Economic Development Authority programs.

The EDA awarded businesses in Camden 10 of the 12 single biggest tax incentives under its Grow New Jersey program, designed for companies adding or retaining jobs in New Jersey. Five businesses in Camden got awards of more than $100 million while one – Holtec – received a $260 million incentive.

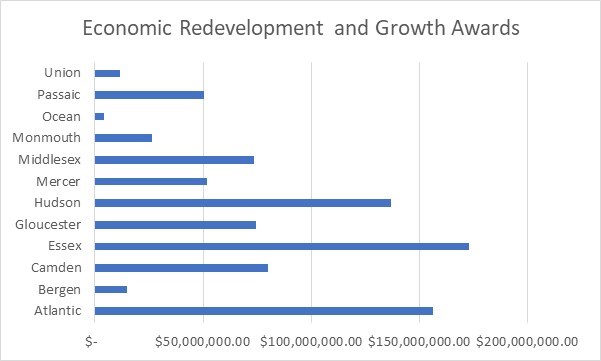

Atlantic City got multiple big-ticket awards under a separate program. Developments in the casino town saw $156 million in Economic Redevelopment and Growth incentives over the last five years, according to our analysis. Seven projects in the city of 36,000 received almost as much as the $161.6 million in incentives offered to 10 different projects in Newark, population 285,000.

The state comptroller recently found the EDA was not monitoring the performance of the incentive programs.

South Jersey projects such as the Stockton University campus in Atlantic City and the controversial Holtec plant in Camden are among the biggest awards meted out by the New Jersey Economic Development Authority. Over the last five years, the programs have not moved the needle on the southern counties’ higher rates of poverty. When new incentive legislation was crafted in 2013 by lawmakers from around the state, it was pitched as a way to address higher foreclosure and unemployment rates in the south. The law included “bonus” incentives for developments in what it called “deep poverty pockets,” “distressed municipalities” or “Garden State Enterprise Zones”. The law also reduced the numbers of jobs companies in the eight southern counties would have to add or retain under the incentive programs. Developers in the south were also held to lower standards of capital investment.

Under the ERG program used in Atlantic City, tax credits were issued for residential developments as well as some commercial and infrastructure projects. The program handed out credits that could be cashed in with brokers for about 90 cents on the dollar. They were so popular that the program is now on hiatus, the EDA says.

But our analysis shows that some of the awards the EDA made were for projects that appear to be on hold. The developers behind the Atlantic City Polercoaster, for instance, still have rights to $38.4 million in commercial ERG credits without beginning construction. (EDA officials did not respond to requests for comment). Similarly, a $1-million-award agreement with DeWalt Brewing Company, which promised in 2017 to bring 15 new jobs to the city’s Inlet neighborhood, is still active on the EDA’s books but there is no sign of DeWalt in the city.

You can download a copy of the Excel-format spreadsheets here. Proceeds from selling data help support our reporting.

Really excellent reporting!!